Growing need for risk management to finance U.S. power supply

The growth of power generation capacity increasingly depends on fixed-price contracts. Long ago, in the

regulated era, development was based on guaranteed economics as all capital costs were borne by

ratepayers on the basis of fixed returns. But in recent decades following deregulation, development of

new generation has been undertaken by a growing share of independent power producers on more

commercial terms. Given the long-term nature of these assets, a significant portion of development

requires price risk management via financial hedges on power prices and/or fuel input costs.

This trend continues as independent developers today account for the vast majority of new capacity –

especially in renewables. Indeed, given the unique economics of renewable assets – where far more of

the costs are at the development stage and relatively little in ongoing operations – such guarantees on

the price of power are especially important. As renewable development accelerates in the years ahead,

the need for fixed pricing will similarly accelerate.

The increasing use of fixed-pricing mechanisms to fund new investment has repercussions beyond

developers of power generation. Those mechanisms involve financial intermediaries and, increasingly,

power distributors and end-users. Commercial and industrial consumers, in particular, who previously

bought power on a floating-price basis have greater choice today not only in who supplies their power,

but also in the terms under which they may fix their prices. They can do so via physical contracts or via

financially-settled ones; either way, they need to understand the risks and benefits of such obligations.

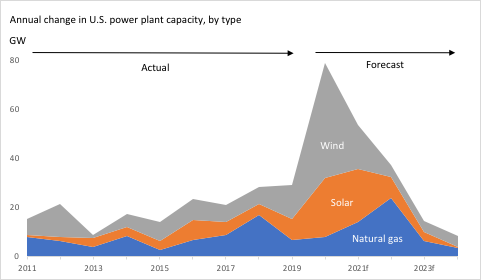

The chart above shows how significant renewable assets have become in recent years as the U.S.

generation stack evolves. This chart shows only new capacity and does not consider retirements –

mostly of coal and nuclear assets – that have effectively offset the growth in natural gas and renewable

generation. Overall, U.S. generation capacity has increased at a far slower rate than is implied above.

Demand, or load, has grown even more slowly – if at all – during these years, allowing excess capacity to

grow in most regions.

Nevertheless, with costs of new generation falling and government initiatives promoting renewable

power generation, there is an ongoing shift away from traditional sources and into new development.

This will continue for the foreseeable future as long as capital markets continue to view the industry in

favorable terms, as it has done in the past. Banks and other lenders are willing to take exposure to

independent power developers as long as they have some guarantees around economics of the assets.

Those guarantees have changed over time and we discuss their evolution below.

Developer hedges: Power purchase agreements (PPAs)

The most common means for fixing revenue streams among renewable power developers is via physical

contracts at agreed-upon fixed prices extending out several years and, in some cases, decades. These

fixed prices allow the developer to forecast more accurately their revenue stream, notwithstanding the

variability of their generation (due to wind speed and, for solar, the strength of sunlight). Since these

assets tend to be sited in places where those natural resources are more predictable the revenue

forecasts tend to be reasonably dependable.

On the other side of these contracts, consumers also get price certainty for at least a portion of what

they purchase. To date, more than 90% of U.S. PPAs have been between developers and local utilities in

which the buyers are a diversified portfolio of the utilities’ customers. In many of these agreements, the

decision by utilities to participate may largely be a function of state mandates to purchase growing

shares of renewable power. They are priced in accordance with observable forward markets, but often

with an inflation assumption in the years beyond which forward markets are most liquid.

While still a small share of the total PPA market – less than 10% --those between developers and private

entities are growing in both absolute volumes and relative to utility PPAs. These agreements also are

based on observed forward markets and, often, with inflation assumptions for longer-dated tenors. To

date, most such contracts have been signed by companies in two distinct industries: Food and

beverage, and technology. Both are significant consumers of power, the former in their manufacturing

and storage processes and the latter to power vast server farms supporting their commercial activity.

Banks and auto manufacturers are also increasingly active buyers of PPAs.

Despite their significant power needs, these industries aren’t the most intensive users of power. Others,

particularly materials manufacturers (metals, glass, wood products, including paper and other

packaging) are the biggest consumers relative to the value of their products. Yet most of these

companies have not yet participated in fixed-price purchases. Moreover, few of them appear to hedge

their exposure to floating power prices via financial derivatives. Instead, they tend to be mostly exposed

to price volatility, although this could change as power developers continue to push across their

customer base for fixed pricing to fuel their growth.

Heat rate call options and revenue puts

In addition to PPAs or other fixed-price physical transactions, generators and developers may choose to

utilize financial instruments offered by banks and other financial intermediaries to hedge their exposure

to fluctuating power prices. These financial derivatives do not require a utility or commercial buyer to

offset the exposure of the generator. Instead, it is the bank that acts as the price guarantor, and the

bank then has to consider its own means for managing the price risks it absorbs in the process.

Two of the most common forms – heat rate call options and revenue put options – have been

instrumental to the development of natural gas combined-cycle (NGCC) capacity over the past several

years. Heat-rate call options are priced on the differential between power prices and the fuel input cost

(e.g. natural gas). Developers sell the calls and generate a significant cash cushion to satisfy lenders,

while giving up the upside in the plant profitability. As such, this structure isn’t really a hedge against

lower plant profitability. It is, rather, a way for the plant owners to monetize the upside in their

economics. In order to achieve requisite premium for the option, they tend to be struck fairly close to

the prevailing forward price; i.e. nearly at the money. This clearly narrows the potential profitability of

the plant until such time as the agreement expires, after which the plant reclaims full upside.

The buyer of heat-rate call option (e.g. the bank) thus becomes exposed to a decline in the value of

power vs. natural gas. Should that differential fall below the strike price, the options become worthless.

As such, the financial firms that tend to buy these calls from developers would typically sell forward

contracts on the differential (spark spreads) at an appropriate delta ratio in order to offset that

exposure. But this selling pressure has often been met with tepid demand from potential end-users,

especially for the portion of the curve beyond the first few years where end-users might otherwise be

willing to fix their prices. As mentioned above, vast swaths of U.S. industrial consumers do not hedge

their power purchases in any way, whether via physical contracts or financial ones. With banks

struggling to sell the forward positions they took on from developers via heat-rate call options, there

emerged an alternative form of financial hedge – revenue puts – that would enable developers to

continue to expand with some financial security.

Revenue put options are similar to heat-rate call options but involve opposite cash flows. In selling heat-

rate calls, the developer monetizes its upside by receiving a premium upfront in exchange for limiting

the plant’s potential profitability. For revenue puts, the developer buys

the option, in this case a put

option on the power price (outright or vs. natural gas). This option would pay the developer should

power prices decline but comes at the cost to them (the option premium); thus, the opposite cash flow

from the heat-rate call option. Also, unlike heat-rate call options, the strikes on revenue puts tend to be

relatively far below the prevailing forward price (i.e. out of the money).

Banks tend to be the sellers of revenue puts. But unlike their role as counterparties to heat-rate calls,

banks that sell revenue puts tend to have less exposure to the underlying price of power because the

strike prices are typically so far out of the money. As such, they don’t need to sell significant volumes of

power into the market and can more comfortably sit on their position, unhedged. For this same reason,

these options can be viewed as insurance-like tail risk mitigation to the developers, paying them only

when power prices fall so far as to significantly threaten their economic viability.

The increasing need for consumers

Banks are doing all that they can to find buyers for the power exposures they take on from developers’

hedges. It isn’t easy. There is the common timing mismatch between the long fixed-price tenors

needed by developers and the shorter preference among consumer hedgers. There may also be basis

exposure between the locations that developers want to sell forward vs. those that consumers want to

buy forward. And the underlying indexes of the options that banks trade with developers may not be

particularly relevant to consumers, who are exposed to the outright price of power – not the differential

between power and inputs such as natural gas. Banks need to warehouse a variety of smaller risks in

the process of offsetting their most significant exposures.

Ultimately, as new power generation capacity continues to grow and developers need to hedge, there

will be increasing pressure on consumers to participate. Prices have fallen fairly consistently with lower

fuel (natural gas) inputs and declining renewable cost structures. To the extent this trend continues,

consumers may be even less incentivized to buy forward than they are today. Long-term fixed-price

agreements can introduce significant marginal costs to businesses if their competitors remain on

floating-price agreements in a downward-trending market. As such, they need additional reasons to

consider locking their prices.

Such reasons may have little to do with pricing. As with their utility counterparts, companies that have

agreed to buy power via PPAs often proclaim their interest in doing so to fulfill a commitment to green

power. That commitment may vary across firms but some are so committed that they seek to achieve

100% of their power consumption from renewable sources. Of course, they cannot say that the actual

power flows they consume are from a given asset – unless they operate that asset. But they can

proclaim that their PPA volumes meet or even exceed their physical consumption.

This branding-related aspect of PPA buying is different from decisions that might be taken on purely

economic terms. But it remains an important force in decision-making and may only increase in

relevance as awareness of climate change permeates corporate management. Shareholders have been

holding companies accountable for environmental (as well as social and governance, or ESG) decisions.

Signing PPAs or other agreements for renewable power can offer an easy way to demonstrate

accountability, as long as they can do so on market-related pricing benchmarks.

As with any other commodity, physical and financial fixed-price contracts on power involve both market

and credit risk. Market risk comes from fluctuating value of any hedge position. Since the position

extends forward in time, changes in its value typically is many times the exposure of any given spot

position. For example, if a company consumes 10 units per month of a given commodity and is not

hedged, then it’s risk during any given month is to the 10 units it is short as those are the only units it

buys during that month. But if it agrees to a contract for two years forward, then it has become long

240 units and fluctuations in the market will have an outsized impact in the company’s mark-to-market

value. It may not need to report that PnL in any given month, quarter, or year, but the valuation change

is nevertheless apparent and should be measured carefully.

The two-year contract also has credit risk. As its value rises and falls, each side to the contract needs

assurance that the other side will perform on its obligation. Contracts may be intermediated by banks

or even exchanges, even those intermediaries present credit risk. That exposure needs to be measured

carefully as well.

There is already a clear role for advisory firms in commodity derivatives spanning industrial metals and

energy. But relatively few such firms offer expertise in electric power contracts. This may be due to the

relative recency of deregulation and, perhaps more importantly, the still-limited volume of long-term

contracts relative to other energy markets. But the market is changing rapidly. The need for advisory

expertise will only increase as developers keep building and commercial and industrial companies are

inevitably drawn into the market in greater numbers.

Appendix: Forward power prices and their relevance to financing power generation

For much of history, U.S. power generation capacity crept upward along with load growth as regulated

utilities sought to maintain a healthy amount of excess reserve through time. Regulated markets were

designed to ensure adequate, but not excessive, capacity. Even as portions of the market underwent

deregulation since the 1980s, new entrants developing independent capacity have been constrained by

economic forces from adding excessive amounts. Market pricing of new capacity dictates its long-term

value and most developers rely on forward prices to gauge the value of their output. The natural shape

of those markets is contango, driven in part by similar shape of the forward curve for the marginal fuel

input – natural gas. Aside from mid-winter, natural gas forward prices are almost always in contango.

Such a shape of forward prices encourages additional investment in capacity, much as it does for other

commodities such as agricultural products and some other energy sources. This is unlike the shape of

forward crude oil prices, which tend to be backward and, thus, punishes those seeking to hedge their

investment in new capacity. As it has with crude oil, though, sell-side hedging pressure can eventually

push a contango curve toward a flat or even backward shape. This is happening to the forward power

markets; recent hedging pressure has pushed forward prices lower than spot prices, especially in the

ERCOT region where that hedging pressure is greatest.

This development in the shape of ERCOT forward prices is no coincidence. Most of the recent

independent power production development has taken place in that region and adjoining ones. ERCOT

has the fastest load growth in the U.S., the lowest excess reserve capacity, and some of the best wind

and solar opportunities throughout North America. Texas’ friendly business environment facilitates

development as well. It is no wonder that developers have chosen this region to site a significant

portion of capacity growth over the past several years.

And yet, despite all of the additional capacity, the spot market in ERCOT remains higher than for other

U.S. regions. This is due in part to a number of plant retirements – mostly coal facilities – that have

limited the overall pace of capacity growth even as new capacity has come online at a rapid pace.

Indeed, load continues to grow as quickly as capacity growth in ERCOT, keeping reserve margins tighter

than elsewhere.

It is perhaps also worth noting that ERCOT doesn’t have capacity payments, which is a significant

component of revenue for generation owners in some of the other deregulated U.S. regions and could

act as an incentive to resource development. Nevertheless, ERCOT does have a unique incentive

mechanism to encourage investment: the ability for prices to rise to $9,000/MWh should the reserve

margin fall below a certain threshold. This incentive is often viewed as akin to capacity payments.

Until quite recently, independent (deregulated) capacity development had been focused on coal and

natural gas plants where economic hedges were only required for perhaps 5 years forward. In general,

commercial and industrial hedgers would offset the generator selling – if not completely then

sufficiently to allow forward curves to maintain their historically contango shape.

Only in the past five years or so, as renewable power generation has taken off in a major way, the

financing requirements have gotten more onerous to the borrower. The need to hedge 10 years

forward has extended the tenor for commercial hedging beyond the limits of most buyers. This

particular selling pressure explains much of the shift in ERCOT’s curve into backwardation.

As discussed above, capacity additions to the U.S. power market will be maintained at the recent pace

and may well accelerate over the next few years. Certainly, the investment climate suggests as much,

and changes in the U.S. tax benefits for renewable power favor rapid development through 2024. This

new capacity needs to be hedged, as lenders won’t participate without it.

Unlike the past several years, however, the capacity additions over the next several years are unlikely to

be as concentrated in the ERCOT forward curve. Indeed, given all of the offshore wind development

envisioned for the Atlantic Coast through 2030 there will likely be a more significant impact on the

shapes of forward curves in PJM, NYISO and ISONE and perhaps even MISO. The impact on the ERCOT

curve won’t be as uniquely affected by new capacity anymore.

This shift in development toward a broader geographic region has significant implications for the

relative shapes of forward power curves. In short, it implies that the deferred portion of curves outside

ERCOT will fall relative to deferred ERCOT prices. As for the front end of the various curves,

fundamental supply and demand, reserve capacity and, of course, weather will continue to play

significant roles.