Source: EIA

Expert advice for every step in your climate journey

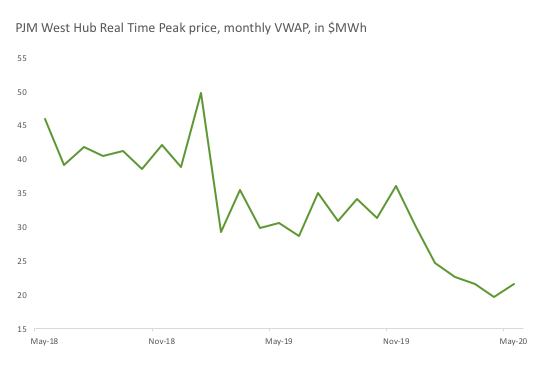

Learn moreThe coronavirus pandemic has caused significant volatility in energy markets. A sharp reduction in economic activity has reduced demand for oil products, natural gas and electricity, pushing prices lower. Some markets – primarily oil – have recovered somewhat due in part to a concerted cutback in supply and a consequent balancing of fundamentals. Other energy markets, especially those with somewhat fixed supply capacity such as power, remain at or near recent price lows.

Investor interest in owning energy tends to arise at times like these when prices are low. And there is evidence that such interest has been supportive of the recent price rebound in oil and, to a lesser extent, in U.S. natural gas. But this does not extend to U.S. electricity markets where, regardless of the fundamental picture, investor ownership of the commodity is comparatively limited.

Private investor interest in power is almost exclusively focused on asset ownership, where exposure to the spot price of power tends to be largely hedged away via long-term fixed-price agreements. Investment in power supply has allowed development to grow rapidly in recent years, especially in renewable generation capacity which is dependent on such investors to finance its expansion. Growth in capacity, in turn, has helped to push prices steadily lower in most regions of the U.S. This has occurred not only in spot markets where supply/demand balances are most clearly manifest, but also further out on the forward curve where owners of those projects need to hedge.

Facing lower prices, developers planning for additional capacity are counting on commensurately lower costs in order to justify such expansion – especially with demand forecasts weakening from coronavirusrelated economic contraction. And while those costs are indeed declining, there is no guarantee that they’ll continue to do so indefinitely. At some point, forward prices may fall to levels that no longer allow such rates of development. This may have already begun, especially as tax benefits that facilitate development in the U.S. are becoming less significant.

In time, those same price declines could begin to attract investors as long-term buyers, supplementing the forward purchases of commercial and industrial consumers. This would be a significant development for power markets and is far from given. How and why such buyers might participate in the market – effectively taking the other side of developer/producer hedges – is the focus of this brief.

Investment in energy takes several forms, including equity, secured and unsecured loans, project finance, and various types of securitized debt instruments. Investor-owned utilities have been a stable component of most diversified equity portfolios and, over the past few decades, so too have their deregulated counterparts – independent power producers. Until the 2000s, almost all available equity investment was directed toward those two industries.

With the advent of new sources of power, especially renewables, equity opportunities have opened for a raft of new participants: developers of utility-scale and smaller-scale distributed power systems; suppliers and distributors of equipment to those companies; and, more recently, developers of battery systems. Although many of these companies benefit from government support programs, capital investment in the U.S. is funded mostly from financial institutions, private equity, and public markets.

Understanding the investment environment of these companies takes effort. There is more than a century’s worth of regulation surrounding public utilities and those regulations vary significantly by region. More recently, as renewables have taken increasing market share, developers and their investors must consider various government incentives designed to continue the shift away from carbon-based sources. These incentives add up and have had a significant impact on the overall financial performance of a range of assets. Participating investors must have specialized knowledge to fully understand such factors and their impact on their expected returns. For this reason, perhaps, a significant portion of equity financing has come from private sources rather than public markets.

Such an environment differs from other energy investment, including oil and gas exploration and production, where some degree of government incentives may drive strategy but where exposure to market factors is more transparent and valuation is somewhat easier to assess. The understanding that such companies respond to market signals, in turn, helps investors make their own determinations about aggregate supply and demand for relevant commodities. It isn’t necessarily easy work, as it often requires analyzing that portion of companies’ exposure that has been hedged and thus is no longer subject to spot market prices. But since most companies maintain at least some exposure to market prices, their behavior can – via individual sensitivities – be expected to reflect changes in those prices.

The interplay between commodity prices and enterprise values provides opportunity for oil and gas investors interested in participating in both markets. There is constant comparison between relative value of equities vs. commodities, and many investors understand commodity markets well enough to utilize them for valuation and calibration of financial models. They may also take positions in them to offset – or magnify – exposures they have from companies in their portfolios.

There is comparatively little such activity among investors in electric power. Utility stocks, in particular, reflect returns of highly-regulated companies for which a large portion of their margins are effectively fixed over time. Spot wholesale prices are less relevant to enterprise value since a significant portion of their revenue is based on sticky retail prices. One would not expect supply to be curtailed during low- price episodes as would be the case among oil and gas suppliers, including E&P, midstream, or refining.

Valuations of independent power producers tend to be more aligned with spot wholesale prices, and their equities suffer in low-price environments. This is especially so among the higher-cost producers such as those owning inefficient gas turbine plants that are designed to produce when demand is especially high. The relatively low utilization rates of such assets lead directly to lower profitability, but still not as directly as that of a natural gas producer or processor. The decisions made by independent power producers are based much more on fixed costs and are also affected by such non-generating considerations as capacity payment mechanisms and other incentives to maintain available capacity.

To summarize, investors in utilities prize consistency while those invested in independent power producers seek the opportunity to participate in high-demand situations. Neither investor expects their industry’s capacity to decline from a sharp drop in demand – and prices – over the course of weeks or even months as commonly occurs other energy markets. They understand, as do traders of power futures, that electricity supply capacity is relatively price inelastic.

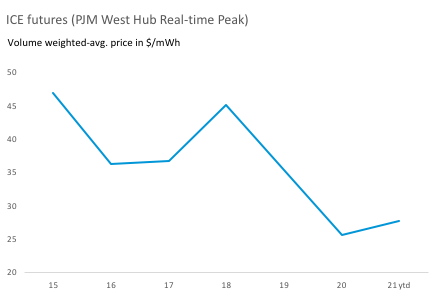

This inelasticity has implications for futures trading. We discussed above that oil and gas investors may actively trade equities and bonds against futures or other derivatives. They can translate changes in commodity market conditions to the expected profitability of companies with exposures to those various commodity prices. In power markets, equity and debt investors respond mostly to factors outside the commodity markets, requiring relatively little interplay between those securities and futures prices. The power futures market – especially further out on the curve – is overwhelmingly composed of commercial hedgers.

A subset of power investment – renewable energy – has grown in relative importance in recent years. Much of its capacity growth has been fueled by government tax incentives that are especially attractive to independent developers, facilitating a new industry in competition with the existing order of regulated utilities and established independent power producers. Renewable energy developers tend to be financed privately and, in keeping with the more established investor base in power generation, they favor stability in their expected returns.

Indeed, the typical financial structures employed in the development of renewable resources involve fixing power prices well into the future, via power purchase agreements (PPAs), virtual PPAs, and similar fixed-price contracts. The combination of equity and debt financing utilized to build and operate these assets requires a significant portion of the future power price to be guaranteed by buyers, often for 10 years or more. As such, investors in these projects (including tax equity investors) are effectively seeking a coupon payment that does not reflect the underlying spot price of electricity. They are similar to more traditional investors in power generators and distributors, with limited commodity exposure and little reason to consider trading their investment against commodity prices.

Such investors may have to accept a degree of commodity price exposure, especially at the furthest forward time horizons where PPAs may not allow effective hedges. And surely there is basis risk in PPAs and other hedge structures – even in the nearer-future periods – leaving investor/owners with a degree of commodity risk. Intermittency in power supplied by renewable assets adds yet another element of commodity price risk. But overall, the mission of such investors is to enter into long-term agreements that reduce as much of that risk as possible.

The future for renewable generation remains bright, according to most analysts’ expectations, although the current pandemic is likely to lead to some reappraisals. Most forecasts prior to the outbreak called for consistent investment growth which, when coupled with efficiency gains, would lead to linear if not geometric growth in capacity during the 2020s. With utility-scale wind and solar now accounting for 10% and 4%, respectively, of U.S. power generation capacity, these are no longer the cottage industries they were a decade ago.

Such forecasts expect the following trends to continue: 1) utilities will extend commitments to renewable sources as a growing portion of their future power consumption; 2) commercial and industrial consumers will do the same as interest expands beyond the relatively narrow base of technology companies, financial services firms, and retail-oriented food producers; 3) state governments play a bigger role in mandating renewable power supply within their jurisdictions.

Such growth in demand for renewable power provides a foundation for continued development of new generation, most of which is expected to come from utility-scale solar and, eventually, offshore wind. With total U.S. power demand remaining flat or declining – as it most certainly will this year – there is also an underlying assumption that the new capacity will force additional retirements of legacy generation assets. Total generation capacity is likely to grow by a lot less than new renewable capacity.

Source: EIA

Most forecasts of the changing U.S. generation stack are agnostic to spot prices, which have been in secular decline for several years in most regions. This may be due in part to the relatively low importance of price to many of the long-term buyers, who contract for renewable supply primarily for environmental impact. Declining prices have been a bonus feature; not necessarily a driving force.

This trend may continue for another several years, encouraging new development and available capacity even as it adds further downward pressure on prices, both in the spot physical market and in the forward markets where these companies hedge to guarantee their project economics. On the other hand, if prices drop sufficiently the old assumptions may no longer hold. Indeed, this may already have occurred in some regions of the U.S. where excess capacity is severe and transmission networks cannot alleviate the imbalance. In addition, the recent economic contraction may further lessen the attractiveness of equity investment in new capacity.

It is possible that further declines in equipment and construction costs will provide a sufficient offset, and that expected rates of return from investors will decline with interest rates. But tax incentives have already begun to matter less to investors in renewable projects because overall corporate tax rates have declined since 2017; the relative attractiveness of a structure that monetizes tax credits thus is lower than it had been in a higher corporate tax environment. Going forward, the planned phasing out of specialized programs that aided the renewables industry – the production tax credit and investment tax credit – will further reduce the relative attractiveness of investing in wind and solar versus, say, a thermal power plant. Discussions with participants in tax equity structures suggest that the market had indeed begun to contract – even before the coronavirus crisis hit.

Nevertheless, as private equity pulls back, others may step in. Utilities, in particular, have been relatively negatively positioned in the renewables space by not being able to take full advantage of available tax credits. With more equal tax treatment, their relative position will improve and it is reasonable to assume that they may shift away from buying renewable power from independent producers toward investing in their own production. This might also occur as states increase their renewable portfolio standards (RPS), a requirement that falls squarely on the regulated utilities. Several states have recently increased their RPS requirements through the 2020s and 2030s.

If utilities take up a greater share of development the corresponding propensity to hedge may be somewhat lower. Unlike private equity investors, whose projects can only sell power into the wholesale market, utilities have captive retail customers who pay regulated rates. Depending on the jurisdiction, utilities might simply put the risk of their investments onto their rate base – for better or worse. This won’t be possible in several states with restrictions on utility investments, but it could allow for a new class of renewable development that isn’t quite as highly dependent on wholesale markets.

Overall, continued growth of renewable resources – regardless of the mix of owners – will require forward contract selling at fixed prices in order to limit commodity price exposure. And in the absence of a significantly wider crop of buyers, such selling is likely to continue pushing long-term prices lower. This has been a key topic in our previous papers and one that has led to related discussions about willingness for intermediaries to warehouse some of that commodity risk, as well as considerations about the role that electronic marketplaces might play in disseminating it (see http://alphapoweravisers.com).

We have discussed the roles of various energy investors and how they differ across sectors, including oil, gas, and power. Specifically, we highlighted the greater commodity-price exposure of investors in oil and gas and how they might seek more direct exposure – perhaps offsetting, or hedging – their equity exposure directly in commodity markets. Investors in power, by contrast, tend to have less commodity price exposure and less motivation to trade it directly in commodity markets.

We are in the middle of a global pandemic that has had profound implications for all commodity prices, especially energy. Demand curtailment has pushed prices to historically low levels, while the more recent supply response has allowed prices to rebound slightly. Energy equities, especially exploration and production companies, have been hammered along with the commodity price declines and have rebounded somewhat tepidly with the recent rebound.

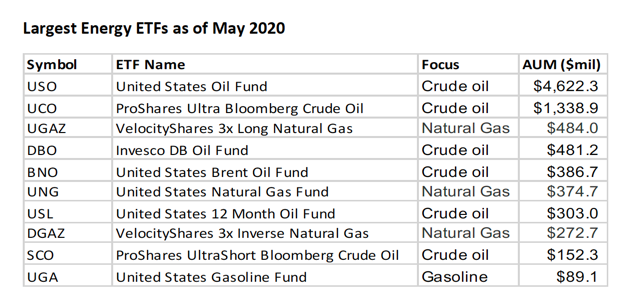

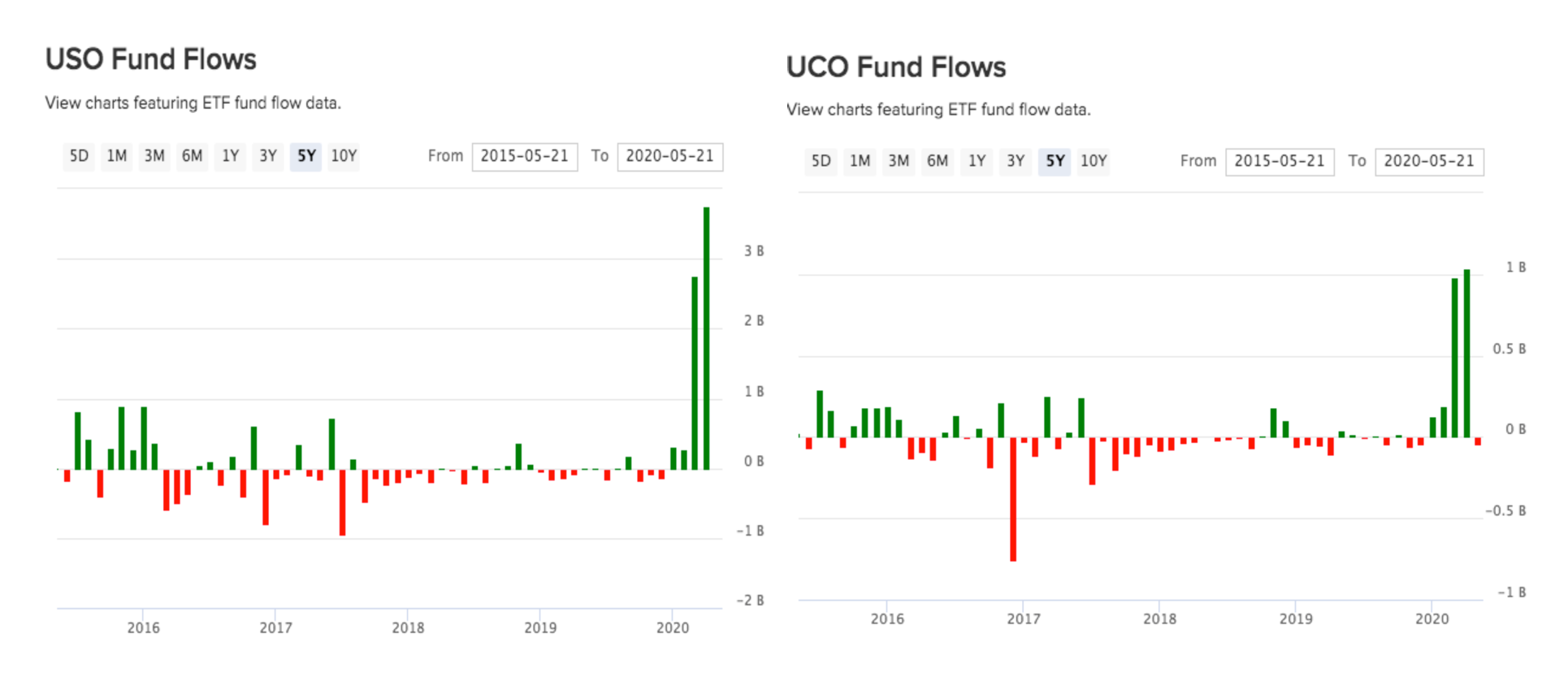

The supply response in oil and gas markets has brought about a groundswell of interest among institutional and retail investors, not only to buy the equities at historically depressed levels but also to buy the commodities, most visibly via passive investment in futures-backed ETFs. The table below lists the largest publicly-traded ETFs in energy futures.

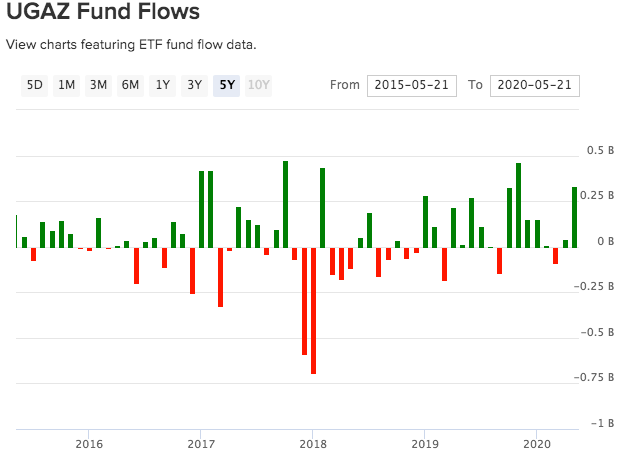

The recent investor interest in the top two ETFs is indicated in the charts below. The focus has clearly been in crude oil. Investor interest in natural gas ETFs has been more muted but certainly held up as prices declined during the first quarter of this year.

Source: ETFdb.com

It should be noted that these investment vehicles have performed terribly in recent years, not only due to the general decline in energy prices but, more so, due to the frequently negative yield from rolling futures as they approach expiration. Many commodity funds invest in nearby futures contracts, or those that have relatively short times to maturity. These are considered to be the most relevant to inflationary pressure – arguably the main reason that investment funds got involved in commodities in the first place. Commodity fund managers have shifted their approach over the years, mostly by placing their exposure further out on the forward curve where prices are generally higher and where depreciation from negative roll yield tends to be less severe.

The electric power market overall has been far less affected. The relative insulation from commodity prices has allowed the equity valuations for utilities and independent power producers to decline by less than oil and gas companies, and with a consequently smaller rebound in recent weeks. Similarly, futures prices haven’t had any of the groundswell of ownership interest that oil and gas markets have seen from passive investors such as ETFs. There are no ETFs backed by electricity futures and other commodity index-related investment pools tend to exclude power contracts given their relatively low liquidity.

Also, investors probably recognize the lack of supply response to the sharp decline in electricity demand. They understand that supply (capacity) is likely to continue increasing (unlike oil and gas supply), even amidst lower wholesale commodity prices. Such an expectation surely is consistent with the experience of the past several years in which lower prices haven’t slowed the pace of development.

But at what point does the price of power become sufficiently low to materially slow the rate of development? And if this happens, could such a development draw investor interest to want to own the commodity price exposure as they have chosen to do in the other energy markets? What form might that interest take?

In the absence of more standard investment vehicles, there is an alternative to gain exposure to longterm electricity prices: Investors could be to join the ranks of commercial and industrial buyers of financially-settled power purchase agreements. To commercial buyers, these contracts’ guaranteed price over several years acts as a hedge against any subsequent rise in spot prices to which the enterprise remains exposed. If prices were instead to decline, as they have done in recent years, the fixed-price contract has the opposite effect: declining in value to offset the cheaper spot market price.

To an investor, such an agreement might take the very same form but instead would behave more like an outright long position in the price of power, where rising prices produce positive returns and falling prices cause negative performance. The investor doesn’t have physical exposure to hedge against, so the performance of the fixed-price contract alone represents the entire profit and loss.

Financially-settled swaps do the same thing, and have been utilized for decades by commercial enterprises and investors alike. A swap on, say, the price of natural gas in the U.S. Midcontinent could be utilized by a producer or industrial consumer to hedge their production or consumption. It could also be utilized by an investor seeking to gain long or short outright exposure to natural gas prices in that region. Investors are often credited with providing additional liquidity to markets on which commercial and industrial companies depend for their hedging.

Such investor activity in power purchase agreements doesn’t exist today. There is no evidence from public data that any investor pool has bought into PPAs or VPPAs. But there should be no reason that an investor couldn’t buy into a financially-settled VPPA given the similarity of cash flows to other financially-settled obligations.

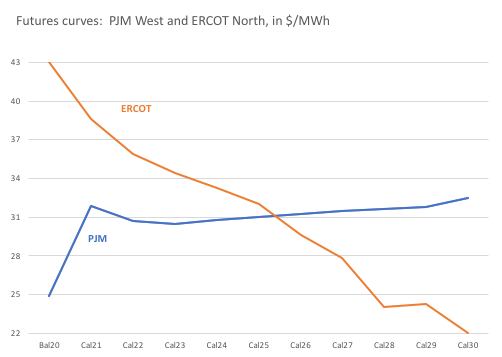

Investors would have plenty of choices to consider in the forward markets for power. Regional differences are significant and governed by very different regulatory regimes, and forward prices reflect a variety of expectations for long-term power prices. The chart below shows the different shapes for PJM (Northeast) and ERCOT (Texas).

The shape of the ERCOT forward curve is perhaps the most interesting from an investor’s perspective. It’s strongly backwardated shape reflects a few key attributes: Relatively high prices over the next few years are consistent with a relatively tight regional supply/demand balance – the tightest excess capacity (reserve margin) in the U.S. ERCOT’s energy market allows prices to rise significantly in high- demand periods that can raise longer-term average prices. The lower prices in the back of the curve clearly reflect the ongoing hedging needed to grow capacity in the region. To the extent that investors might buy into a longer-term position and eventually roll it forward into the future, such a forward curve shape allows for positive roll yield.

Investing in PJM, by comparison, is more akin to investing in oil and gas today. The contango shape of the forward curve reflects softer physical balances over the next few years and less hedging pressure further out in time. The shape of the curve alone makes it a less attractive position than ERCOT forwards given the flat or negative roll yield.

Both regions, as well as the rest of the U.S. (and Canada) are likely to reflect relatively subdued economic activity over the next year or so. Prices could well continue to fall as demand is held in check. But for investors considering the longer term, VPPAs offer the ability to participate in power price appreciation for 10 years or more. A lot that can happen over that period of time. There is a broad range of price paths that can emerge from continued development of new resources; retirement of legacy assets; economic contraction and subsequent expansion. A tighter supply/demand balance is entirely possible, especially if the pace of development slows in the next few years.

In addition, there are externalities to consider, including the potential for U.S. power prices to reflect a more coordinated effort by the federal government – perhaps in concert with foreign governments – to institute limitations on national carbon emissions. Such an effort could take many forms, including trading of emission credits, but would likely have a direct impact on electricity prices.

Investors might also consider their role in buying forward power to be enabling to the growing renewable power industry. Many of those already invested in such assets are vocal about their role in the energy transformation. Taking the other side of those contracts – buying power contracts from the developers – cold have similar appeal to their stakeholders aside from investment performance.

Currently it may seem far-fetched for energy-focused investors to consider long-term power contracts as attractive assets. But assuming overall economic activity allows projects in the pipeline to proceed as planned there will be a need for buyers to step up and provide liquidity to the developers needing to hedge their projects. Utilities, as well as commercial and industrial companies, are likely to remain the most important buyers. At the right price, investors might be willing to get involved as well.