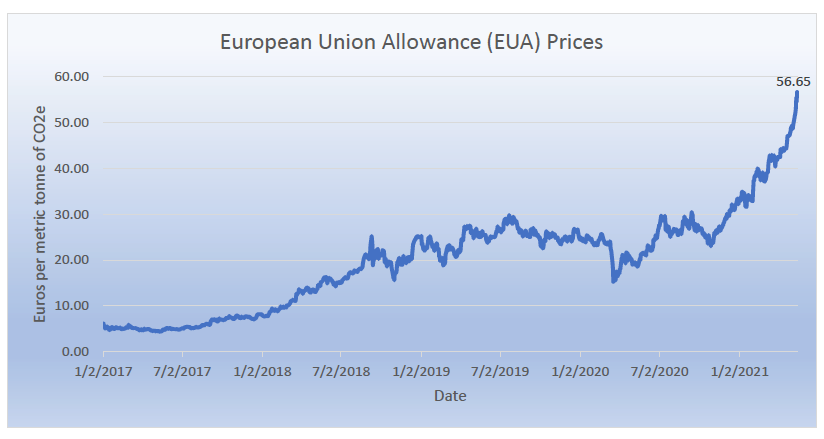

Source: Carbon Pulse, May 2021

Expert advice for every step in your climate journey

Learn moreCarbon markets have developed in fits and starts over more than a decade as a mechanism for achieving climate goals of both public institutions and private enterprises. Placing a price on emissions raises the cost of carbon-intensive goods and services, making those choices less attractive than low-carbon alternatives. Such a market-based mechanism has clear merits when compared to more direct bans on consumption that might otherwise be imposed by government authorities.

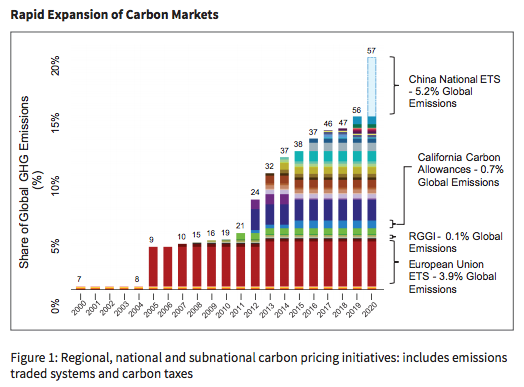

Interest in carbon markets has risen more significantly in the past couple of years, along with public awareness of climate change and growing commitments to reduce carbon dioxide emissions. But the interest is far from universal; rather, it is focused on certain regions of the world and specific markets within those regions. It’s still a small patchwork of efforts that affects a minority of energy sources in most markets and a very small minority of energy sources globally. The mix includes both government mandated (compliance) schemes and, increasingly, privately-negotiated (voluntary) ones.

Market prices differ greatly across schemes and even among individual projects. Nevertheless, a broad shift has emerged among compliance markets this year in anticipation that demand will continue to grow in the face of limited supply. Prices are rising to record highs across forward curves, encouraging investors to enter the market via newly-created mechanisms, in private securities and a public exchange-traded fund (ETF).

One of the biggest potential developments going forward would be for the United States government to impose a national carbon-pricing scheme cover the power sector and, perhaps, other industries. By restarting its participation in global efforts under the United Nations Framework Convention on Climate Change – the Paris Accord – the Administration is committing to cuts in U.S. emissions of greenhouse gases, a significant share of the global market. Yet the U.S. doesn’t have an enforcement mechanism to achieve such goals. A properly-functioning carbon market, which is a critical component of the Paris Accord, would provide such a mechanism.

Carbon markets are an interesting complement to commodity and equity markets associated with energy and other raw materials. Indeed, given their proliferation throughout the world these markets will almost surely become more relevant to broader financial markets and asset valuation in the years ahead. But understanding demand and supply of carbon credits isn’t straightforward given the outsized role that governments play on the supply side. Moreover, there are a host of voluntary schemes that are often referenced in discussion even though they have little or no bearing on compliance schemes.

This paper highlights some aspects of carbon markets that are relevant to corporate risk managers, especially those seeking to develop assets that depend on forward markets to guarantee their economic returns. Carbon markets can provide such assurances, especially if they provide a floor to wholesale power markets. But these markets are unique; they are unlike commodity and financial markets and have their own elements of risk. As in all of our previous work, the objective is to understand how these markets might affect long-term pricing for energy and, by extension, the economics of developing new power generation and storage assets that may emit carbon dioxide as well as those that do not.

We have highlighted in several previous papers the risks to future development of power generation resources from the rapid growth of existing capacity and its impact on long-term commodity (energy) prices. Long-term power prices are critical to the financing of new resources, including generation, storage and, potentially, transportation and distribution. Such market signals provide the clearest incentives for the allocation of capital among alternative uses.

But there may be a significant disconnect between market incentives for future energy development and government’s expectations, or commitments to such development. Without some form of external price support, all of the new capacity coming online could easily push wholesale, and futures, prices to levels that prohibit investors from earning adequate returns on their investments. This would slow the pace of development, perhaps significantly, upending many of the underlying assumptions for continued heady expansion of renewable resources. A carbon-pricing mechanism could provide such countervailing support, effectively raising the price of power by utilizing market-based mechanisms.

This isn’t likely to happen anytime soon in the U.S. Despite the Administration’s stated environmental goals and its commitment to the international community, it needs to enact policies via legislation and the creation of a national carbon pricing scheme is not yet on the front burner. Nevertheless, there is a consensus building that eventually the U.S. will enact such a system, as will other developed economies that have yet to do so. U.S. participation would contribute a hefty contribution to indexes of global carbon prices. Investors and others following the price of carbon in existing markets would do well to understand the pace and depth of development of the U.S. market.

Our focus here is on carbon trading schemes. By contrast, carbon taxes are direct government levies on carbon dioxide emissions: a set fee on a given mass of carbon dioxide emitted. As such, carbon taxes can directly affect the behavior of consumers and producers but the magnitude of the overall impact on 3 carbon dioxide emissions is uncertain. Carbon taxes also tend to be fixed for long periods of time, so adjusting the tax rate based upon its observed impact on behavior can be difficult to implement. Such taxes can be assessed on a wide array of energy products, including power, natural gas, petroleum and coal. They may have different assessments regardless of the fuels’ carbon intensity as there may be external motivations (e.g. national security) for incentivizing some fuels over others.

Carbon taxes aren’t relevant to our discussion here because they aren’t market-based. They don’t directly affect the price of electricity or other goods and services that are produced from burning fossil fuels. Where carbon taxes exist power generators might need to raise their prices in order to operate profitably on an after-tax basis, but their sensitivities vary considerably and the markets would not receive a strong price signal from their individual pricing decisions. In any event, the U.S. government is unlikely to choose this path for achieving its broader climate goals.

The main alternative to carbon taxes is cap and trade, often referred to as carbon markets. Unlike carbon taxes, they start with a collective volume of observed emissions and a goal for a volumetric reduction that forces emitters to either cut their volumes or buy credits to offset volumes above a predetermined amount. The market determines the price of those credits. Cap and trade programs take advantage of market dynamics more than carbon taxes do. They effectively allow emitters (and their customers) to make rational choices about their behavior based upon how the market values emissions. At low emission prices, decisions are easier.

Importantly, in a cap and trade system the price of carbon is perfectly transparent, as it trades in the open as a physical contract and can easily be developed into a futures market. For this reason, it is the means by which signatories to the Paris Accord have chosen to implement their pledges and would most likely be the means by which the U.S. progresses toward such goals.

Typically, the first thing that comes to mind about carbon trading schemes is their impact on consumers of energy. Significant emitters of carbon dioxide, mostly heavy industrial operations, tend to be the target of cuts and therefore most punitively affected by such programs. In those cases, the amount of carbon emissions in the manufacturing process directly affect the (higher) price at which the emitter must sell its goods and still remain profitable. Its customers, as well as those further downstream in the value chain, share in those higher costs. Less carbon-intensive competitors are advantaged and, likewise, so too are all of their customers downstream in the value chain.

In addition to heavy industry, most carbon trading schemes tend to focus on another sector with significant emissions: utilities and independent power producers. Unlike industrial emitters, however, power generators are themselves producers of energy or, perhaps more appropriately, they are converters of one form of energy (coal, natural gas, or oil) into another (power). As such, a carbon pricing scheme that includes power generators can raise the price of electricity to the rest of the economy, not just to those downstream in a particular industry.

It is easy to see how a carbon pricing scheme would be helpful for promoting renewable generating assets. It effectively raises the price at which a generator must sell power in order to operate profitably after factoring in the cost of its carbon emissions. Coal-fired plants, for example, would have to charge the most to their customers in order to recoup their environmental costs. On the other end of the spectrum, nuclear and renewable capacity would have no environmental cost and thus no additional charges to their customers. In between, natural gas-fired plants would have lower environmental costs than coal but higher than nuclear and renewables.

The price of carbon can play a clear role in the relative prices of inputs like coal and natural gas, depending on the carbon intensity of the fuel (coal can vary by type) and the cost of carbon allowances. But it can also play a role in the absolute price of electricity. Generally, the correlation should be positive: as allowances appreciate they make it harder for fossil-burning generators to operate profitably at given input costs, so they need to recoup the cost via the price at which they sell power. If carbon allowances depreciate, they allow generators to sell power at lower prices.

As long as carbon prices have positive value, they provide a floor to power prices produced by assets that are carbon neutral or, at least, less carbon intensive than the current mix of assets. If power generators are obligated to pay for their carbon emissions, the impact on power prices can be significant. Nowhere is this more important than in Europe, where the carbon price can constitute more than half the total cost of generation.

Source: Carbon Pulse, May 2021

In anticipation of a national carbon trading scheme in the U.S. it might be helpful to look at some of the most significant trading schemes around the world to get a better sense of how they operate. Although some of these programs have been around for a long while, it is still relatively early days in the development of carbon markets throughout much of the world and there is likely to be significant expansion in the years ahead. The U.N. Climate Change Conference later this year (COP-26) is likely to address carbon-market development among constituent countries that haven’t yet enacted them.

The European Emissions Trading Scheme (ETS) is unquestionably the most developed carbon market in the world. It is a cap and trade system of allowances (EUA) with the most transparent pricing and deepest liquidity. The European Union decides what is an acceptable level of carbon emissions in a given period of time (years) and then either gives away a corresponding amount of credits (to disadvantaged industries) or auctions them off (to stronger ones). If collective emissions threaten to exceed the capped limit, those who emit beyond their quota will have to bid into the market or pay the penalty for exceeding their quota. Current and forward prices are listed on public markets and sufficient liquidity allows companies with exposure to buy and sell based on their balancing needs.

Importantly, although the ETS started up during the early 2000s, it still only covers a minority of carbon dioxide emitters among the European countries where it has been implemented. Commercial and residential properties, for example, are not subject to it. Nor are cars and trucks. The scheme only affects heavy industrial facilities, utilities and other electricity generators and airlines which together constitute about 40% of total carbon emissions, though it is slated to include a greater share of emissions in the future. The United Kingdom was part of the ETS until it exited the European Union; it has since created its own ETS program modeled largely on the EU ETS as a cap and trade program.

Source: IHS Markit

A key provision for the EU and UK systems – indeed, any such system – is to avoid regulatory arbitrage. Countries and regional blocs that have already instituted such schemes need to make sure that their constituents don’t simply move operations to other countries were such restrictions are softer or nonexistent. Once a region embarks on a carbon scheme they have every reason to want other regions to do the same, or they may threaten those other regions to act or find themselves subject to punitive trade policies.

Existing carbon trading schemes are incorporating such terms into their policies. The European Union, for example, is considering imposing tariff barriers on goods imported from countries that don’t implement similar climate-related costs on their manufacturers (for now it is simply granting waivers to those industries most exposed to it). One of the important areas of discussion at the upcoming U.N. meeting is a harmonized system of carbon prices that treats all companies the same regardless of where they operate in a broad bloc of countries.

The threat of carbon-related tariff barriers is likely to have driven China’s implementation of a national carbon market in the past year. It had been under development for more than a decade, including government-backed regional experiments in carbon trading, but has now implemented a national program that covers a significant portion of power generation. Understandably, it started with generous allocations of carbon allowances that pose relatively insignificant costs to utilities and power generators. In time, as other industrial sectors are included, the government’s allocation of carbon allowances should reflect a tighter supply-demand balance.

Aside from China, there aren’t many established national carbon trading schemes in Asia. South Korea and New Zealand have such programs but other major economies, including Taiwan and Japan, have yet to develop fully-functioning national carbon markets (Japan has developed a couple of regional schemes). Similarly, there are no significant programs yet underway in Africa nor in Latin America. The most significant schemes outside of Europe and Asia are in regional jurisdictions of North America.

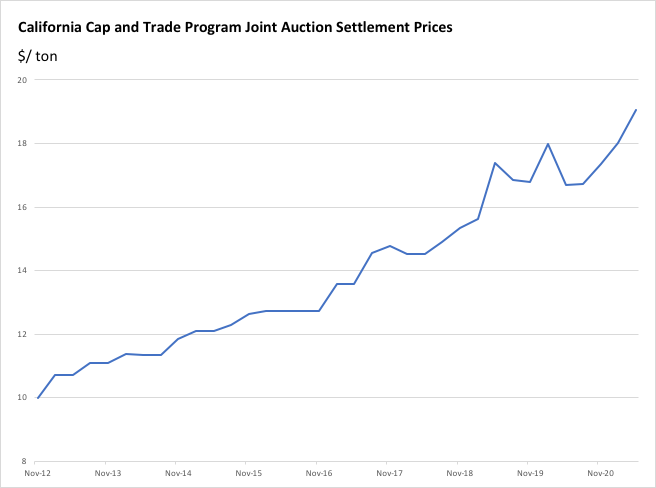

California’s program is the one of two main markets in North America and by far the most significant. The program was initially conceived to include several other western states, as well as provinces in Canada. But so far it has only been implemented in California and Quebec (Ontario joined but then withdrew from the scheme in 2018).

The California program has developed over time to include emissions from a widening array of industrial and commercial enterprises. Initially it included only power generation, petroleum refining and heavy industry but has since been expanded to commercial enterprises, agriculture and, importantly, distributors of transportation fuels and natural gas, which effectively includes their downstream usage. As such, California’s program is estimated to affect roughly 80% of all carbon dioxide emissions in the state – a far higher share of total emissions than any other program in the world.

California’s carbon trading scheme incorporates a feature that limits price depreciation: the auction price at which the state sells new credits is guaranteed to appreciate by 5% above the rate of inflation in perpetuity. This encourages buyers to hold their credits even if they do not need them as future prices 7 will almost certainly be higher than current prices. California’s scheme also has a feature that allows the state to issue more supply should prices rise beyond a certain threshold, effectively limiting upward price volatility. This government option is not unique to California’s program; other governments retain the right to amend supply in their carbon trading schemes should prices rise beyond a stated threshold.

Source: California Air Resources Board

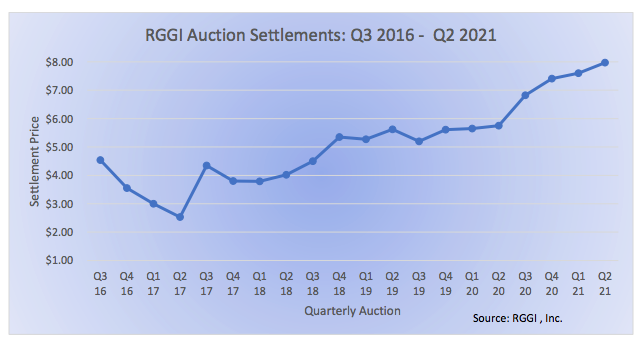

Separately, 11 U.S. states in the Northeast and Mid-Atlantic have banded together to form the Regional Greenhouse Gas Initiative, or RGGI. This program, which pre-dates California’s, still only covers electric power generation and thus affects slightly more than 10% of those states’ total emissions. Additional states may choose to join in the program in future, and Pennsylvania is expected to formalize its participation within the next year.

As with California’s trading system, the RGGI program incorporates a price floor mechanism although the floor is set at a lower level and has a somewhat flatter appreciation rate. And it has a similar mechanism to offset upward price spikes: new supply of credits can be auctioned off if prices reach predetermined threshold levels that escalate through time (e.g. $13/ton in 2021). RGGI trading volumes are considerably smaller than in the California program and this has limited the degree to which noncommercial traders and market makers are active in the market.

Source: Carbon Pulse, June 15, 2021

In the absence of a national compliance market in the U.S. various companies have made commitments of their own. Their motivations may vary but all share an interest in broadcasting to their many stakeholders that they are taking climate change seriously and are willing to enter into agreements that may involve significant cost in order to demonstrate their individual commitments.

Voluntary carbon markets are completely different from regulatory/compliance ones. Rather than trading the usual currency – fungible certificates equivalent to a ton of carbon dioxide emission – voluntary programs are far more bespoke, bilateral agreements. Typically, they involve a commercial or industrial company as buyer and an agricultural or forest-management company as seller. The credit is based on the seller agreeing to maintain its ownership of carbon-dioxide consuming land or assets for a set period of time. Such trades are often referred to as carbon offsets.

The voluntary carbon offset market has developed rapidly in the past few years as buyers and sellers can both claim to be facilitating a reduction of carbon usage in any given trade. But there is a major problem with voluntary systems: lack of enforcement or verification of the carbon-offsetting promises made by sellers. Given the sometimes misleading representations by companies engaged in these markets one could argue that buyers get what they pay for, in some cases very little. To the extent that much of the market’s success is predicated on public relations, lack of enforcement may not be a problem for participants.

But lack of enforcement is certainly a problem for anyone tasked with measuring aggregate carbon emissions and offsetting emissions reduction across an entire economy. The U.S. government today has no doubt taken note of the efficacy of voluntary efforts and understands that the nation cannot achieve any reasonable emissions goals without a scheme that is actually enforceable.

Voluntary trading of carbon credits has another, more significant, problem that is also more relevant to our discussion: lack of accurate and consistent price signals. Voluntary credit transactions are famously opaque, with carbon prices that vary significantly (often by several factors) depending not only on the location and tenor but also on the parties involved. It is easy for companies purchasing voluntary offsets to pay more to intermediaries than to the ultimate seller. It’s a feel-good market that has characteristics similar to other such markets where utility and valuation are secondary to the benefits of public image.

Thankfully, electronic marketplaces have developed across the world to facilitate voluntary carbon offsets, bringing together buyers and sellers. Singapore-based Climate Impact X, or CIX, is a joint venture between DBS Group, Standard Chartered, Singapore state investor Temasek, and market operator Singapore Exchange. Another marketplace, Carbon Trade Exchange operates out of London and Sydney and is more like a traditional broker, with fixed commission rates. Another, AirCarbon Exchange, is based in Singapore and utilizes blockchain technology. These markets have the potential to significantly improve pricing transparency across regions and classifications of resources.

Voluntary emission markets have the potential to divert demand for carbon credits from compliance markets, or to delay the implementation of compliance markets in countries that are considering them. Any impact on demand is likely to be limited, however, as the drawbacks of voluntary credits limits their legitimacy and, thus, their potential relevance to fulfilling obligations under a government-mandated scheme. Even in those compliance schemes that allow some voluntary credits to be counted toward company goals (e.g. California) the share of those credits is relatively insignificant.

Carbon markets are, by their nature, physical markets. Participation requires actual, physical reduction of emissions or the purchase of agreements to make up the difference. If an obligated party cannot demonstrate that it is in compliance with limits on its emissions it must deliver to carbon market operators a requisite number of allowances to make up the difference.

Keeping track of the prices of those contracts is a bit bewildering because most of them are issued in vintages corresponding to a given calendar year. Obligations trade at levels that reflect the specific supply and demand for that vintage. In general, participants may utilize any given vintage of credits for any subsequent obligations; it isn’t uncommon for contracts from past years continue to trade long after the vintage year has passed.

But as with most physical markets, especially those with a reasonable degree of volatility, commercial participants may wish to hedge their future exposure if they can do so transparently and cost- effectively. Futures contracts provide such a hedging tool and IntercontinentalExchange has listed futures contracts for each of the three main physical carbon markets (EUA, CCA, and RGGI). Those contracts can be traded at prices that correspond to the various vintages of each region. And they are easily transacted on a screen.

Futures markets also allow participation by noncommercial traders such as financial asset managers (e.g. hedge funds and institutional investors). Indeed, the recent increase in prices for carbon emission credits has brought about a significant increase in noncommercial interest, especially in the past year. This corresponds to the overall increase among investors in ESG-related investments.

Each of the regional, or country-specific, carbon markets are independent of each other and reflect only local market conditions of supply and demand. For this reason, prices differ considerably and will likely continue to do so as long as they operate independently. Such is a defining feature of the Paris Accord: that all jurisdictions enforce their own carbon-reduction schemes independently, and verifiably.

Nevertheless, given interest in futures markets by noncommercial investors IHS Markit has created its Global Carbon Index, akin to all of the various indices on commodities, equities, and other financial markets. Currently, the index covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gas Initiative (RGGI) and utilizes futures prices for its inputs. The global index provides a means for investors to diversify their existing portfolios further with an asset class that isn’t highly correlated to anything. Moreover, by combining the three futures contracts the index provides a portfolio effect that reduces volatility relative to its component markets.

Investors seeking to trade the index have a few alternatives. They can participate in private offering with a specific counterparty such as a bank that is willing to write a contract based on the index performance. They may also participate in dedicated investment pools focused on these futures contracts. And they can trade directly via a publicly-traded ETF on the IHS index: the KFA Global Carbon ETF (ticker KRBN) which is backed by a basket of futures. The ETF’s assets under management have grown substantially since its inception roughly one year ago, to almost $400 million currently.

To be sure, investors may be attracted to carbon credits as an asset class because it fulfills an objective to invest in ESG-related themes. They may also be attracted to owning such agreements because they believe that supply is relatively fixed while demand is likely to continue to grow. California’s built-in price escalator provides an additional factor meant to limit the market’s downside.

For investors in futures or the ETF there is the question of roll yield. All carbon markets display varying degrees of contango, which is associated with negative roll yield that, for some commodities, can drag down the overall performance of the asset significantly. But environmental markets are different from other commodities and those differences may limit performance comparisons to commodity markets. The biggest difference is the cumulative nature of vintages; ie. that any given year’s allocation can be used to fulfill obligations in subsequent years. This feature by itself limits the degree of contango since a steep slope would encourage participants to hold their positions longer, keeping selling pressure off the front of the futures market.

Another major difference is the role played by governments that limit the issuance of future credits based on their overall objectives in carbon emissions reduction. The very nature of more stringent emissions limits suggests lower supply in years to come. As mentioned, those governments have the option to make adjustment to their issuance depending upon market conditions. But the impact of such an action would arguably have an equal impact on prices across the forward curve.

Another distinction worth noting: commodity markets are commonly viewed as being mean-reverting, so persistent contango term structure tends to have a direct, negative impact on performance. But the notion of mean reversion is foreign to investors in carbon credits, and to investors in the carbon ETF in particular. Their expectation is for capital appreciation over the long term. As such, the relatively modest contango shape of emission credit futures is relatively immaterial.

The carbon trading schemes that form the basis for today’s futures markets might be expected to reflect tighter supply over the next several years as their respective governments increase their commitments to carbon reduction. But what about schemes that don’t currently exist, such as a national U.S. program? Or among schemes that exist, such as in New Zealand and South Korea, but are not yet sufficiently liquid to warrant futures markets? Might carbon prices in those other markets have an impact on existing futures values in, say, Europe?

The average price of carbon globally cannot steadily increase if new markets are established with the usual surplus of credits to get them started. As governments establish new programs they are more likely to be lenient in order to facilitate the transition. So it is likely that any U.S. national carbon price would remain under downward pressure, perhaps for a period of years, before the supply constraints begin to bite, ultimately putting upward pressure on prices.

But since these programs remain independent of each other, the slow starts of new markets are unlikely to put downward pressure on the existing ones. And attempts at regulatory arbitrage by companies seeking to lower their carbon costs might well end up being punished by tariff barriers imposed by their own countries or regional blocs.

As for voluntary programs and their potential role in market valuation, their impact is likely to remain low or nonexistent due to the lack of fungibility with compliance markets. As discussed, their existence can potentially sap the demand side of regulated markets but probably not in a meaningful way. Their lack of uniformity could just as well lead to their taking a lesser role in the future. As such, investor interest is likely to remain squarely in contracts based on government-mandated programs.

A more rigorous approach to compliance-market valuation it isn’t easy. While it may be possible to forecast supply and demand for a given scheme, there are significant externalities than can affect the price of carbon. Economic growth and energy intensity matter, of course, which is why carbon prices fell everywhere at the start of the pandemic last year. Markets reflected (accurately) the sharp contraction of energy demand as transportation and manufacturing contracted. Markets today reflect the sharp rebound of both economic sectors. Such moves were not out of the realm of other commodity markets, including oil and gas and, to a lesser extent, power. All of these markets reflect a significant reassessment of demand in the face of relatively fixed supply or capacity.

But there is a significant difference between environmental markets and other commodity markets when it comes to the supply side. Commodity supply – whether in industrial or agricultural markets – reflects economic incentives to produce and market the product in question. Such incentives have longstanding impacts on behavior that can be modeled with a significant degree of confidence. Environmental markets, by contrast, may experience sharp changes in supply for entirely different reasons: government choices.

Notwithstanding our discussion of these valuation issues, our interest in this subject not so much from the perspective of those investing directly in carbon credits. It is more about the perspective of those investing in assets whose values are directly affected by carbon markets; namely, those investing in various power generation and storage assets.

As discussed above, there is a clear linkage between carbon pricing and the relative attractiveness of inputs for power generation across the stack, from carbon-intensive fuels (coal) to renewables. Carbon emissions from natural gas-fired plants (CCGT) are roughly 0.4-0.5 tons/MWh. Coal plant emissions are considerably higher: 0.9-1.0 tons/MWh. But the impact on the outright price of power is less straightforward, especially at low carbon prices. This is akin to other environmental markets such as RINs in the U.S., where the price of obligations may not be material to the overall fuel market until those prices reach a threshold level.

In Europe, with carbon now routinely trading above $50/ton, there is an acute need to understand the marginal cost of production and how much those generators must factor into their wholesale market pricing in order to maintain profitable operations. Even during low-demand seasons and off-peak hours there is still a need for baseload power generated by carbon-intensive generators. But such merit orders differ considerably across European countries and regions based on varying asset composition.

In North America, where carbon prices remain considerably lower, there is less clear direct mapping of emission credits to power prices. Most analysts instead point to other factors to explain changes in spot prices, including weather and its impact on consumption as well as production from renewable sources (amount of wind and sun). Given coal’s relatively diminished role in baseload generation in California, natural gas prices tend to be a more relevant factor.

In addition, power prices differ considerably across the U.S. and Canada given transmission constraints. Carbon prices in California aren’t relevant to power prices in PJM, for example, or Ercot, even at significantly higher price levels. Still, there is reason to expect carbon pricing will ultimately affect a broader coverage of U.S. states – whether under a national scheme or expansion of existing regional ones. And, with time, carbon prices could appreciate far into the future.

Such an outcome would eventually become relevant to power prices throughout much of the U.S. and, by extension, affect financial decisions about additional resources and their likely returns. Carbon markets are likely to have an increasingly meaningful place in financial risk management of power generation and storage assets. And they could provide support to spot and forward commodity prices in ways that have relevance to decisions about investment in additional capacity.