COP26 in Glasgow: limited impact without a uniform carbon market

The pace of the energy transition from fossil fuels to renewables is expected to receive a significant

recalibration in the next few weeks as representatives from nearly 200 countries gather in Glasgow for

the 26th United Nations Conference of Participants (COP26). This gathering is one of a series of mostly

annual discussions for negotiating national and supra-national limits on carbon emissions.

Although this particular COP is an important one – and the first since the global pandemic – participants

have recently been ratcheting down expectations for its outcome. There are a number of headwinds,

starting with the current energy crisis afflicting most of the world’s power sector with rising natural gas

and coal prices. Declining investment in fossil fuel extraction and processing is now manifest in limited

supply of most carbon-based fuels and, with demand rising rapidly following the pandemic, balances are

tightening and prices are rising to multi-year highs.

Today’s higher prices for energy may eventually curtail demand for fossil fuels, which would be

consistent with policy makers’ goals, and would be even more likely to do so if resource prices increase

further. Such an outcome is certainly possible given the sluggish response of oil and gas supply to the

post-Covid demand rebound. But market actions are independent COP deliberations, which tend to

address perceived longer-term market failures. If markets alone could achieve national emission-

reduction targets there would arguably be no need for treaties or diplomacy.

The intention of this year’s COP is to push all member states to increase their individual commitments,

or nationally determined contributions (NDCs), to curtailing or limiting carbon dioxide emissions beyond

current market incentives. The last major COP accord – the Paris Accord in 2015 – didn’t garner

sufficient NDCs to achieve the UN’s goal of limiting the rise in global temperature to 1.5%-2.0% C. But

substantive agreement on further commitments is unlikely this year for a number of reasons. And even

if the conference produces a broad outline among nations to decarbonize it is unlikely to be credible

without an enforcement mechanism that still does not exist.

Lacking commitment to raise energy costs further

Even at current elevated energy prices there is limited willingness among consumers to reduce demand

for fossil fuels, whether to protect their finances or for the sake of the environment. Indeed, consumers

today are demanding more supply of oil and gas, not less, as certainty of supply for the looming winter

in the northern hemisphere is foremost on their minds. Governments understand the urgency and are

taking actions in the short term to alleviate perceived supply shortages.

Longer term, of course, nations may still make pledges to further the transition toward less carbon-

intensive energy sources. But those making such pledges cannot accurately forecast future energy use

across all of the various sectors of their economies. As such, these pledges are simply goals to be

modified through time depending on conditions such as the current market tightness as well as the

success or failure of programs to incentivize the transition to renewable and low-carbon resources.

Next month’s COP will focus on furthering carbon dioxide emission reduction goals, and there will be

plenty of disagreement about which nations – and specific industries within those nations – should bear

the brunt of the effort to achieve them. There will be lots of talk about curtailing energy use and

improving efficiency and resource allocation. But there appears to be little chance of serious discussion

about the best, and most enforceable, means for doing so. Enforcement is everything to the

effectiveness of agreements, regardless of the scale or scope. This applies equally to private business

contracts as it does to large, multinational trade and climate agreements. Without enforcement the

motivation for fulfilling objectives is fundamentally lacking.

At this year COP there doesn’t seem to be any significant discussion underway to pursue the most

effective enforcement mechanism for an international climate agreement: a carbon market that would

affect the variety of fuel costs in different ways, depending on each source’s carbon intensity. This is

why COP26 is unlikely to change the trajectory of energy usage beyond what is already taking place

under current market incentives.

A well-crafted international carbon market would facilitate action across the energy spectrum –

including producers, processers, and consumers – to behave in ways that further reduce dependence on

fossil fuels. Goals may be declared and perhaps ratified by individual nations but, as we have seen from

previous such efforts, the actual results can vary significantly from the vision. Governments need a

market-based mechanism if they are going to be able to ratchet – up or down – their goals effectively.

We don’t have a view about whether any particular set of NDCs will achieve the UN’s goal to limit

temperature changes. That discussion is a substantially larger one. Instead, we are simply highlighting

whether or not current trends will change much based on the global meeting that is about to take place.

We believe that those trends will not change in a substantive way without greater emphasis on utilizing

a mechanism such as a carbon market to enforce national pledges.

What the Paris Accord was supposed to accomplish

Six years ago, the meeting of the Conference of Participants (COP21) produced the so-called Paris

Accord, which broadened mandates from previous COP meetings. Specifically, the Accord’s Article 6

pushed the need for carbon markets as the key mechanism for achieving carbon reduction goals. This

was a worthy goal and it showed that the framers of the agreement appreciated the enforcement that a

well-crafted market can provide. It would exact real and transparent financial penalties on the heaviest

emitters of carbon dioxide while granting benefits to those that lowered their carbon intensity.

Unfortunately, the agreement’s language is purposely vague and not particularly binding. Like other

such international agreements it was constructed in order to maximize the likelihood of ratification by

member countries. Nevertheless, it established a framework for trading carbon credits across

international borders on a uniform basis. As in other asset and financial markets, uniformity is key to

facilitate participation and trust in the system.

Trading of carbon credits between countries can only take place if each of those countries establishes

standards in their own jurisdictions that are comparable to those in other jurisdictions. As discussed in a

recent paper (Power Risk, Alpha Power Advisers, June 2021), only a handful of markets have been

developed to date and those are mostly in developed countries. Such national and regional carbon

markets each have individual characteristics that severely limit fungibility among them.

The European Union (EU) has developed the most comprehensive carbon market, affecting not only

utilities but other industries as well and, soon, maritime transportation. The EU is acting independently,

but with the hope that other countries will follow suit and thus reduce the possibility of regulatory

arbitrage across regions. Indeed, the EU is developing trade policy to ward off the distortions that result

from having different carbon pricing across regions (including many with no carbon pricing at all).

Over these past several years, many governments such as that of the U.S. have largely ignored carbon

markets as a means for achieving emission-reduction targets. Instead, some of these countries have

instituted alternative environmental policy measures to phase out fossil fuels from certain industries,

especially electricity generation. For example, a government or its acting agencies might directly limit

the use of coal or other fossil fuels in a portion of generation capacity, perhaps via differentiated tax

liabilities. Such efforts typically phase in slowly and their impact can be limited for several years.

Many countries have not have taken any concrete steps at all to reduce carbon emissions, effectively

kicking the can down the road on the assumption that they have plenty of time to come up with a plan

before the UN’s midcentury carbon-neutrality target. This is the preferred position of many developing

countries, which are counting on contributions from more developed economies to help them finance

such a transition. Those potential contributions are another topic for discussion in Glasgow that will

crowd out the pressing need for international agreement on enforcement mechanisms.

COP 26 and the mandate for the next several years

Nations participating in COP were supposed to submit revised emission-reduction targets to the UN in

advance of this year’s conference. Many have done so under a variety of individual mechanisms, while

others have yet to deliver anything. So, the first task facing negotiators in Glasgow is simply to get more

participants to propose their own stricter carbon-reduction measures, regardless of how they intend to

enforce them.

There may well be pronouncements from the conference that a majority of countries are accelerating

their carbon-reduction goals. There may also be some agreement around enforcement of trade rules

that prevent high-emitting countries to produce goods more cheaply than low-emitting ones. This topic

could well be the focus of much of the discussions as Europe has made it clear they will not allow their

manufacturing to suffer due to their implementation of the most expensive carbon market in the world.

And with trade rules increasing being invoked against China in particular for its competitiveness in labor

markets, COP26 may be one of the stages for this debate.

The COP might even produce some vague language to further the development of carbon markets as a

mechanism for settling the difference in carbon prices across geographic regions; i.e. more of the broad

generalities of the Paris Accord. But unless each of countries with the most significant emissions has a

clear mandate to develop a truly global carbon market there cannot be a fully-market-based system for

settling such scores. Negotiators would do well to focus their efforts on developing better coordination

of carbon markets, as well as enforcement, though this seems unlikely based on the guidance that

leading nations have provided.

The U.S. isn’t likely to provide much impetus

The United States provides a relevant case for the rest of the world. Unlike the EU, the UK, and a

handful of other nations or blocs, the U.S. hasn’t even begun the process of implement a federal carbon

market to guide its emissions reduction. Instead, it has leaned on limited executive-branch mandates

that are specific to power generation to form the bulk of its nationally determined contribution to

carbon dioxide emissions reduction. Meanwhile, state governments have cobbled together a patchwork

of carbon-pricing programs that affect only a portion of the nation. U.S. negotiators will arrive in

Glasgow without a hint of plans for a carbon market, so it will be among the many nations that proposes

cuts in its use of fossil fuels without a direct means for enforcing the outcome.

Of course, it’s noteworthy that the U.S. is participating at all in COP26. The last U.S. administration

withdrew from the international negotiations entirely, so expectations for its role in this year’s

deliberations were already low. The U.S. formally rejoined the COP under the Biden Administration, but

it did so only via executive order and, as such, its participation can best be described as aspirational and

unsupported by a broad swath of the population and its representatives in the legislature. This has

become ever more apparent in the past few weeks as climate-focused legislation has bogged down in

Congress amidst a lack of commitment from both parties.

There is clearly a lack of domestic support for a federally-mandated carbon market in the U.S. and this

reluctance will prevent its negotiators from pushing for such agreement at the COP. Instead, as leverage

to push other nations to reduce their emissions the U.S. is likely to list its mandated fuel reductions in

power generation as well as its expectations for the transition of the automobile fleet toward electric

vehicles over the next few decades. Those pledges, affecting a limited portion of the broader economy,

may be credible given the relatively heavy role of government in the power sector as well as in the

marketing of automobiles (primarily in the form of tax policy).

By contrast, any pledges affecting U.S. fuel use in industry, agriculture, or aviation will have to be viewed

with a significant credibility discount. Tax incentives do not affect those sectors as extensively and thus

has little power to significantly affect behavior. Without any legislative action to incentivize changes to

these industries as well, there’s no credible basis for a pronouncement by the U.S. or any other nation

that it will reduce emissions beyond what might otherwise take place through changing technology and

market incentives.

Beware goals based on trendline assumptions

Member nations may make pronouncements about reducing carbon emissions based on the assumption

that historical trends will extend into the future. One of the most important such trends in recent years

has been the steady decline in cost of manufacturing and installing most renewable resources, including

wind turbines and, especially, solar generation. Economies of scale have indeed lowered the unit costs

of development so that these resources are competitive with traditional fuel-consuming assets

throughout much of the world.

Declining costs of renewable resources is one of the underlying trends that has been built into a wide

variety of forecasts about their growth in deployment throughout the world. Government agencies,

banks, and private forecasting services all maintain forecasts of wind and solar generation capacity

growth and, increasingly, battery storage systems that help reduce their intermittency.

Prior to the pandemic, each of these sources maintained gently-sloping downward forecasts of the cost

of development, typically expressed as investment per kWh of capacity. Such forecasts were essentially

extrapolations of a recent multi-year history during which technological advancement and economies of

scale worked together to improve efficiency and cost throughout the supply chain. Much of the

production took place in Asia and, for most of the past several years, tariff and non-tariff trade barriers

weren’t an issue in the cost structure. [Incongruously, most forecasters also maintained revenue

forecasts that were considerably higher in the future than futures prices implied. They were also higher

than would make economic sense in a world of constantly declining development costs.]

In any event, the pandemic has turned those cost assumptions upside down. The cost of producing and

installing renewable assets has reversed its downward trend in the past year and is rising for the first

time in recent memory. Rising commodity prices, supply-chain disruption, and trade barriers have all

conspired to raise the cost of solar development, particularly in the U.S.

This reversal of trends isn’t reflected in any significant shift in expectations for global emission

reductions, though perhaps it should. We don’t know if it will continue, and it is possible that the

significant increase in capital allocation to the industry in recent years will allow additional economies of

scale to turn the trend back toward lower costs in the future. We simply caution against the assumption

that efficiency gains will steadily work to lower carbon intensity. This is another justification for the

benefits of an enforcement mechanism to ensure compliance with national pledges.

Few countries have a carbon market, or plan for one

Most of the participants in the COP will be in positions similar to that of the U.S., with limited leverage

to enforce decarbonization commitments they are making or will make in the years ahead. Indeed,

many developing countries will refrain from even making commitments without direct financial

assistance from developed economies. Even for those that are considering instituting such an

enforcement mechanism, there are other pressing issues at hand.

To date, there aren’t any international penalties for not taking such a step down the decarbonization

path. The bloc with the most advanced carbon market – the European Union – still hasn’t begun to

penalize its trading partners via tariff and non-tariff barriers for their relatively inexpensive

manufacturing regimes. It is likely to start doing so soon, but there are still plenty of excuses among

other nations for postponing the implementation of a similar program.

Even countries that have established carbon markets, including China’s recent efforts, may have done so

to minimize their cost to consumers and, thus, their impact on behavior. Governments typically begin

with low hurdles – and, thus, low carbon prices – to begin the process of incentivizing investment away

from carbon-intensive sources and into renewables and other low-or no-carbon sources of energy.

Through time they can make adjustments that are consistent with their climate goals.

Europe’s relatively expensive carbon market having a greater impact already

Only the European Union and United Kingdom have so far restricted carbon credits to a degree that has

allowed carbon prices to rise to levels that are having a significant impact on their broader economies.

Their markets already provide incentives and disincentives for economic activity that is affecting the

carbon intensity of utilities, primarily via investment in power generation but, increasingly, in other

industries as well. To be sure, much of the existing European infrastructure dates from a regime in

which governments supported power prices received by renewable developers in order to encourage

investment. But such incentives are fewer today and there is a greater reliance on carbon markets to

accomplish the same goal.

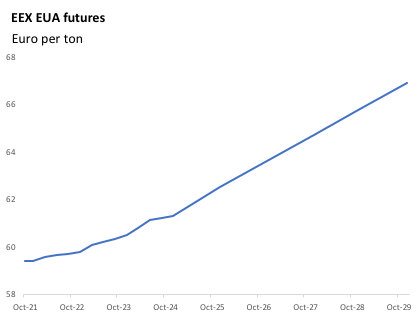

As evidence that Europe’s markets are changing, witness year’s record natural gas prices. North Sea oil

and gas exploration is a fraction of its former levels while investment in renewable energy has been

growing by double digits over the past several years. This is in part due to expectations that carbon

pricing will increasingly eat into the profitability of consuming fossil fuels. Forward prices for European

and UK carbon credits show clearly the degree to which the incentives to decarbonize will remain in

effect and, indeed, become even more significant over the next several years.

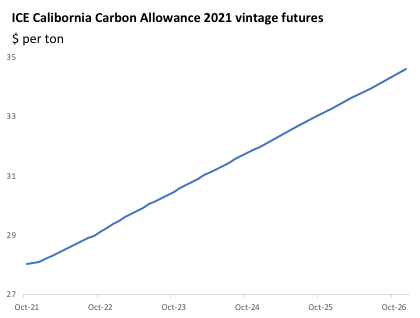

California’s regional market is the second-highest priced carbon market in the world. It’s forward curve

also reflects an expectation that balances will tighten through time as demand grows against limited

supply, raising the price of a ton of carbon over the course of a decade or longer.

Carbon markets can, and will, be affected by government intervention

In Europe, the UK, California and other regional carbon markets, governments can implement target

emission reductions by making credits more or less affordable in the future. They do so by adjusting the

amount of credits offered in any given auction. By issuing a greater number of credits they can push

prices lower and slow the pace of transition. Alternatively, they can tighten supply in an effort to

encourage faster adoption of renewables and other low-carbon energy sources. Such a mechanism has

considerably more direct bearing on investment and consumer behavior than alternative mechanisms

such as industry-wide emission mandates. And because they typically include annual auctions, carbon

markets offer governments an ability to change course in a fairly short timeframe.

Despite their attractiveness as an enforcement mechanism, it is worth noting that even the most

developed carbon markets can be subject to undue public-sector influence when markets are under

significant stress. Indeed, the currently tight global natural gas market is already affecting how

individual governments enforce their own carbon markets. In Germany, for example, a usage tax on

natural gas is being reduced to lower the financial burden on consumers. Such an action is certainly

within their national jurisdiction, yet it has implications for how that country will meet its longer-term

emission-reduction goals. In the absence of a countervailing action, the net result is higher carbon

dioxide emissions.

To the extent that other governments take similar actions, future EU carbon allowances might be

offered in greater volumes, allowing carbon prices to fall and disincentivizing emission reduction

throughout the region. All carbon markets have such relief valves and usage of those mechanisms

lessens their long-term effectiveness. As such, carbon markets aren’t perfect mechanisms for

incentivizing change, but they are the best among other imperfect alternatives.

In summary, what to expect from Glasgow

COP26 comes at a rather inopportune time to consider more rigid limitations on carbon emissions and

the associated cost of doing so. Energy prices are already relatively high. And, while carbon markets

may be the most effective means for allocating resources among competing energy systems (subject to

national emissions goals), by definition they add cost to fuels like oil, gas and, especially, coal. Arguably,

nations like the U.S. missed an opportunity to start such a program when energy prices were relatively

low during the intervening years between Paris and Glasgow.

Governments take long-term views and COP participants will be looking beyond the current commodity

markets with an eye toward a broad pronouncement of goals for emission reductions. They may find

some common ground but are unlikely to be able to back it up with enforceable measures. For those

few nations with existing – and stringent – carbon markets, enforcing goals is as simple as calibrating the

supply of carbon credits. They have a workable enforcement mechanism already, but they are very

much in the minority. For the vast majority of signatories that do not have carbon markets, including

the United States, achieving climate targets is a considerably more complex task.

The U.S. doesn’t have a popular mandate to create a carbon market, so it will most likely continue down

the path it has already taken to incentivize the energy transition: tax credits. These measures have a

reasonable degree of success in the power sector and in shifting the composition of the automobile

sector. But addressing change in other areas of the economy, including industry and transportation

(trucking, air and rail) will remain a secondary focus. To the extent other nations look to the U.S. as a

global leader, they will have a good excuse to move slowly, if at all, on developing carbon markets.

It is possible that persistently high energy prices will allow the energy transition to occur as quickly as

policy makers would like and without intervention in the ordinary market economy. If oil and gas prices

double from here and remain elevated over the course of decades, there will be plenty of incentive for

alternative sources to take their place. But futures market prices don’t reflect such an outcome.

Instead, they imply that the cyclical nature of commodity prices is likely to endure and fuel prices will be

cheaper in the future.

Governments want to facilitate a transition that is more complete – and faster – than markets will allow.

The question is how they go about doing so. They can implement limits on fuel use by industry and can

even implement more direct control on individual entities if they choose to. A far more effective

mechanism would be to harness the power of markets and implement systems to allow private actors to

make those decisions according to clear price incentives.

Carbon pricing: a brief overview of markets and relevance to asset development, June 2021.

https://alphapoweradvisers.com/carbon-markets

What You Need to Know About Article 6 of the Paris Agreement, World Resources Institute, Dec. 2, 2019.

https://www.wri.org/insights/what-you-need-know-about-article-6-paris-agreement

Future U.S. competitiveness depends on effective carbon pricing now, The Hill, Oct. 16, 2021.

https://thehill.com/opinion/energy-environment/576967-future-us-competitiveness-depends-oneffective-

carbon-pricing-now?amp

One giant leap: President Biden’s vision for repowering America, WoodMackenzie, Sept. 2021.

https://www.woodmac.com/horizons/one-giant-leap-president-bidens-vision-for-repowering-america/

What is Cop26 and why does it matter? The complete guide, The Guardian, Oct. 11, 2021.

https://www.theguardian.com/environment/2021/oct/11/what-is-cop26-and-why-does-it-matter-thecomplete-

guide